Last month was a slow month with a dividend income of $479.38 in October. Let’s check out my dividend income for November to see where I end up.

November Dividend Income

For the month of November I received dividends from 14 different companies (and 1 company twice):

| Ticker | Company Name | Nov |

| TSE:RY | Royal Bank | $87.15 |

| TSE:CLF | Bonds | $61.72 |

| TSE:DRG.UN | Dream Global REIT | $55.07 |

| TSE:PLZ.UN | Plaza REIT | $54.91 |

| TSE:AX.UN | Artis REIT | $48.33 |

| TSE:NVU.UN | Northview Apartment REIT | $45.63 |

| TSE:NVU.UN | Northview Apartment REIT | $29.47 |

| TSE:REI.UN | RioCan REIT | $23.97 |

| TSE:D.UN | Dream Office REIT | $22.88 |

| TSE:BEI.UN | Boardwalk REIT | $19.13 |

| TSE:XBB | Bonds | $18.17 |

| TSE:PZA.UN | Pizza Pizza | $15.97 |

| TSE:PWF | Power Financial | $14.92 |

| TSE:XLB | Bonds | $9.84 |

| TSE:SJR.B | Shaw Communications | $7.41 |

| TOTAL | $514.57 |

I received $514.75 in dividends for the month of November. Over $500 dollars for doing very little work. Enough free money to cover the payments of a new car! It’s crazy to think that my dividends alone could buy me a free car.

Nuts and Bolts

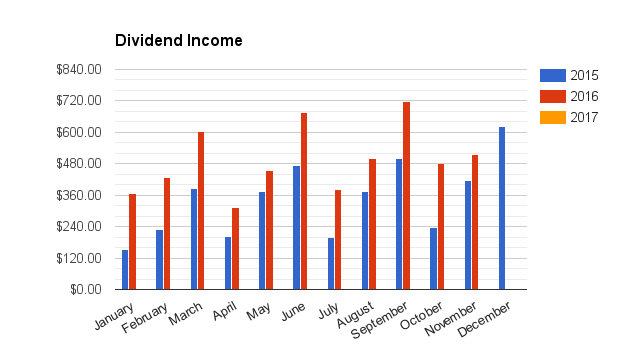

- My year over year increase was 23.10% or $96.57 more then 2015

- My quarter over quarter increase was 2.71%

- I had very little growth this quarter due to saving cash and not buying very much.

| Month | 2015 | 2016 | 2016 $INC | 2016 %INC |

| January | $152.00 | $367.00 | $215.00 | 141.45% |

| February | $229.00 | $427.00 | $198.00 | 86.46% |

| March | $385.00 | $602.00 | $217.00 | 56.36% |

| April | $201.00 | $313.00 | $112.00 | 55.72% |

| May | $375.00 | $456.00 | $81.00 | 21.60% |

| June | $475.00 | $676.00 | $201.00 | 42.32% |

| July | $200.00 | $380.00 | $180.00 | 90.00% |

| August | $375.00 | $501.00 | $126.00 | 33.60% |

| September | $499.00 | $716.88 | $217.88 | 43.66% |

| October | $236.00 | $479.38 | $243.38 | 103.13% |

| November | $418.00 | $514.57 | $96.57 | 23.10% |

Every quarter there are 3 months or dividend payouts, this is the middle one.

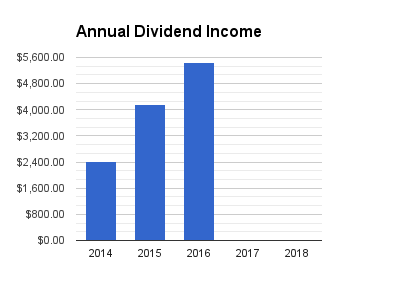

My total dividend haul this year is now $5432.83, already $1,263 more than my last years TOTAL!!

I have already crushed my last years total but I only have 1 more month to reach my goal of $6,000

How Much Free Money?

| Year | Total Dividends Received |

| 2014 | $2,421.00 |

| 2015 | $4,169.00 |

| 2016 | $5,432.83 |

| 2017 | $0.00 |

| 2018 | $0.00 |

| 2019 | $0.00 |

| 2020 | $0.00 |

| Total | $12,022.83 |

Since 2014 I have received $12,022.83 of free money just to own some companies.

How cool is that!

Insane! Keep it up! Greetings form Germany!

Thanks!

From Canada 🙂

You are on a roll!! Love the car payment comparison.

Looking at your monthly run-rate particularly in the end of quarter month it seems to me that you will achieve your target for the year!

It’s going to be close!

I can’t wait until the dividends don’t just buy a car, they buy a house!

Thanks for reading DIB

Solid income for the month of November. That passive total can definitely make a monthly car payment and more. Judging by which companies paid you I can see that you are not shy about owning REITs. Congrats on a solid year over year increase too. Double digit raises are always nice, especially when it’s from a passive source.

DivHut recently posted…December 2016 Stock Considerations

Hi Keith,

I do think I am a little heavy on REITs but there is more to the story then meets the eyes. I’ve owned some of them for years and they have already paid for themselves and then some. For me now it’s just free money.

I’ve been doing my own investing since 2006 but am only focusing this blog since 2014 since I have paid off my house and can now focus more resources to investing.

From 2006 to about 2012 I had to dip into my investments a half a dozen times just to pay for bills or kid stuff when time were tough, so I didn’t really track my progress that much. The REITs were good because I always had cash from the large payouts to withdraw if I needed.

I don’t plan to withdraw anymore moving forward and I might move away from REIT’s all together but I do like the business model of collecting rent and handing it out to shareholders 🙂

Awesome dividend update. Congratulations on crossing the $500 mark. I can’t think of too many things that are more rewarding than the passive income that comes from this kind of dividend investing.

Jay recently posted…Why Technical Traders Shouldn’t Ignore Fundamental Analysis

Thanks a lot Jay,

It’s only going to grow faster in the future as the dividendes start to bring in their own dividends!

Good job I’ll take your slow months and this month lol. Can’t wait to see what Dec looks like keep it up.

Doug recently posted…CFFN Buy

Thanks for stopping by Doug.

I say slow in comparison to my “C” dividend schedule which includes the month of December. I still consider $500 of free money massive 🙂

Hi Steve

Great dividend income over there.

I am a big fan of Reits as well and I owned Reits from other parts of the world. It feels great knowing that you own a piece of all the buildings up there that you usually would go and see.

Keep the work rate up and soon you’ll have a free piece of mind when the kids are grown up.

B recently posted…Recent Action – Spackman Entertainment (SEGL)

REIT’s are very easy to understand, that’s one of the main draws for me.

Just yesterday I went through AR.UN latest quarterly report and feel very confident they can maintain their payout moving forward.

Thanks for stopping by B

Way to go Steve! I continue to be impressed by your YoY growth! Next year I get to report that as well! Great month and keep it up!

Dan

Thanks Dan,

I’m looking forward to you next year. I’m thinking your real estate could see some nice capital gains.

Cheers

wow nice month and great increase since last year! Best wishes! You have cute kids!

Thanks for stopping by and the kind words HHWG 🙂

That year over year growth is insane! Still laughing at the fact there is a company named Pizza Pizza on your listing haha I don’t know too much about the REITs in your listing. but are you concerned with the potential for rising interest rates? Or are you salivating a DRIPing if the stock price tanks?

Keep up the great work!

Bert

Dividend Diplomats recently posted…5 Easy Ways to Save During the Holiday Season

Hi Bert,

Funny story, I was at a place called the PNE in the summer with my kids. I took them to eat at a little food stand for some pizza. After getting some food I noticed the name on the package was Pizza Pizza. I had a good chuckle as I was kind of paying myself 🙂

I am very concerned with rising interest rates. I’m also concerned of an over expensive market going bear 🙁 All I can really do is keep cash on hand because I’m not very good at market timing. Also, interest rate rises are already priced into the REIT’s. I don’t plan to sell my REIT’s and I will DRIP all the way down.

I don’t plan on starting a new position in any REIT’s in the short term but I do like the business of renting out buildings.

Cheers

It’s great seeing growth y/y each month! Keep up the investing and you’ll be covering your house payment each month soon!

Thanks Timeinthemarket.

Slow and steady!

Awesome job with the passive income. It looks like you are well on your way to reaching $6,000 by December. Hopefully it works out for you b/c that would be quite the accomplishment.

Nice job!!!

Mustard Seed Money recently posted…The Upside-Down Wedding Cake

Thanks Mustard Seed Money,

$6,000 is the plan but as long as each and every month my Year over Year increases I will be happy.

This game is a slow one to start but when that snowball gets rolling, look out!

Not just a new car, enough money to pay for a pretty nice new car. Keep up the good work my friend. I like looking at dividends as payments too. I’m thinking of doing an experiment next year where I pay a mortgage using nothing but monthly options income. We’ll see if I can get it lined up or not. If not, then 2018 for sure.

Investment Hunting recently posted…November Dividend Income

If you manage to pay a mortgage using only your monthly options income- That’s BOSS.

If I get time, in the new year, I’m going to try some options. Probably covered calls so I don’t get too deep too fast.

Looking forward to your Dec income IH

Yea for over $500 in dividend income! That’s a lot of money for not having to do anything!

Hi Tawacan

It’s crazy to think that I could get a free car with my dividend payments alone!

I can’t wait until I have enough monthly dividends to pay for a mortgage 🙂

Hey Steve, love the update. Looking at your increases this year, everything has gone up by at least 20% compared to last year, how awesome is that?

Can’t wait to see what happens for you next month 🙂

Tristan

Dividends Down Under recently posted…Saving for the future: November 2016

Heya Tristan,

I can’t wait for December’s dividends to start rolling in.

I’m almost positive I will break the 6 grand mark but like you mention, I mostly focus on Year over Year dollar increase.

Next year I’m going to aim for $200 more per month average over 2016. A very tough goal with my income level but a great challenge nonetheless.

Congrats on the great progress! Hopefully next month you will have a chance to buy more shares. I’m including your monthly income updates as part of monthly round up…

http://www.predictablesnowball.com/2016/12/11/dividend-income-around-world-november-16/

-Snowball

Thanks a lot PS.

I DRIP every month on my REIT’s and I’ve actually bought several companies since my last update.

Cheers