Hello old friends (and new?). What a wild year so far.

So, I had a bit of time on this long weekend and was cleaning up my site and thought to myself, why not a brief update?

I’m still kicking it old-school but time is so precious that I have been way more busy doing than talking about my doings.

Real Estate and other adventures

I’ve been working hard on this area of my business for about 2 years now and have made several strides in that time. I am learning and making a little bit of money through the process. I’ve just enrolled in the London School of Economics Real Estate and Economics Certificate program so let’s see how that goes.

I’ll give a good update on this front when I get into the mood.

I’ve accumulated a handful of rentals but I plan on expansion soon

P2P lending going fine but rather boring. I’ve averaged 12.6% per year since 2017 so I guess that’s ok. It’s miles behind my stocks where I’ve doubled my value in under 5 years. My tfsa is over triple the value of the TSX since 2016

Also, on this chart you can see my RRSP started 10% below the index in 2016 so that 80% gain is not accurate. Plus this doesn’t factor in dividends, just saying 🙂

Stocks

I sold all my stocks on Jan 31, 2020

I’ve been rebuying since the end of March when the US fed decided to use a bazooka and shoot trillions into the economy.

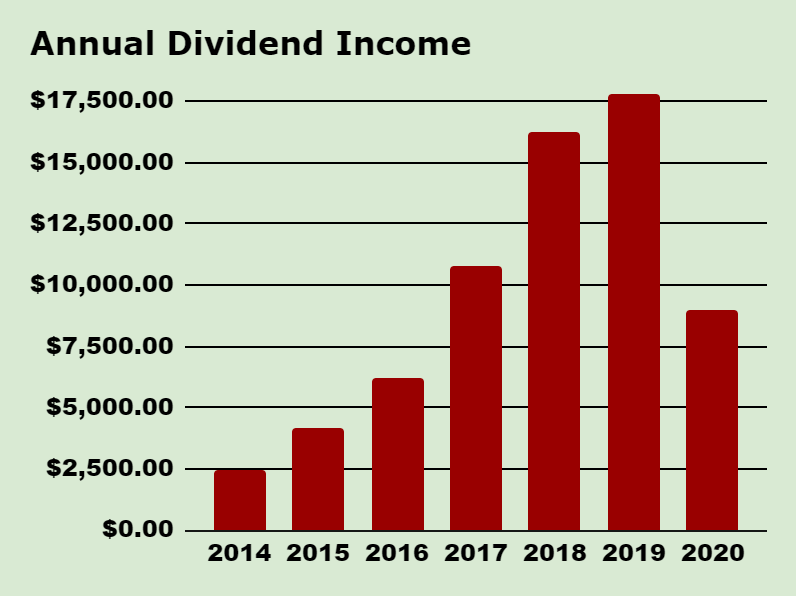

This year, my goal was to pass $20,000 in total dividends received but that changed since I didn’t collect much from dividends at the beginning of the year.

2020 Dividend Income So Far

My total haul this year is only breaking $9,000 so far but I expect it to dramatically increase as I have re-entered the market with only about 20% in cash holdings left.

Because I got lucky and sold at the height and bought back in at an average 37% discount, I should be looking at a very nice year next year (if the market doesn’t explode again!)

Having not really looked to close into it, I would guess I should get an average of about $2,000 a month in my tax-free accounts in the form of dividends. I’m not really counting on every company I own keeping the dividends so we shall see.

I’m also holding much of my portfolio in low or non-dividend paying stocks because I keep these in my taxable account until I have more room in my tax-free accounts.

In fact, my largest holding now is BRK-B which doesn’t pay a divi.

Stuff

| Month | 2018 | 2019 | 2020 |

| January | $1,104.37 | $1,626.86 | $1,595.72 |

| February | $913.47 | $957.73 | $943.22 |

| March | $1,475.55 | $1,501.45 | $40.08 |

| April | $1,356.51 | $1,599.25 | $479.33 |

| May | $934.30 | $972.76 | $277.97 |

| June | $1,530.00 | $1,674.88 | $2,821.26 |

| July | $1,542.41 | $1,668.51 | $1,718.55 |

| August | $984.73 | $891.40 | $1,082.96 |

| September | $1,549.84 | $1,897.46 | |

| October | $1,611.55 | $1,677.00 | |

| November | $1,230.16 | $1,110.34 | |

| December | $1,990.18 | $2,226.97 | |

| YTD Total | $16,223.07 | $17,804.61 | $8,959. |

My total dividend haul this year is like 9g

How Much Free Money?

| Year | Total Dividends Received |

| 2014 | $2,421.00 |

| 2015 | $4,169.00 |

| 2016 | $6,192.86 |

| 2017 | $10,760.51 |

| 2018 | $16,223.07 |

| 2019 | $17,804.61 |

| 2020 | $8,959.09 |

| Total Divs | $66,530.14 |

Since 2014 I have received $66,530 worth of dividends. This does not include any capital appreciation.

Every month I like to see what my dividend income can purchase if I chose to spend it on frivolous stuff.

If I saved all my dividends so far I could buy myself a…

Chevrolet Corvette Grand Sport – $65,495

and I’d still have a grand left over!

Stay classy Fire bros

Nice man

congrats on all your success.

Id love to get a rental building one day but being in ontario I always wonder about the current prices of homes.. Is now a good time to buy one?

I forget where you live but is this something you thought about and how did you overcome it?

cheers

Rob.

Passivecanadianincome recently posted…August 2020 Passive Income Update – $1,145.39

Hey Rob,

I live in a suburb of Vancouver.

When I started my RE journey in 2016 I looked at every market in Canada and didn’t find any that met my criteria fr positive cashflow. I know of some people that have made it work in TB, Windsor, and Moncton but it was not going to work for me.

I ended up on the East Coast of the USA and the moved Central. I have Places in FL, MS and TN.

My problem is I have to settle on one market and make it my home! I’m too easily distracted. Im thinking KS next…

The great thing I’ve found with RE investing is the leverage. With stocks, Ive used all my own money. With RE it’s all the banks money so I’m kind of getting the best from both worlds!

Cheers and hope to chat soon

Welcome back, great to see you active again. You did some amazing timing on sellling your entire portfolio.

Amazing to see your results with selling your stocks and rebuying at a 37% discount. $9k so far is great!

Mr. Robot recently posted…Augustus 2020 Dividend Report

Thanks, Mr R!

It’s tricky finding anytime to update but I’m going to try and do a monthly update even if it’s short.

Thanks for dropping by!