What is it?

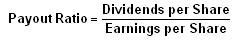

The payout ratio, or dividend payout ratio, is how much money the company earns (EPS) compared to what it is actually paying out to its shareholders in dividends (DPS), typically expressed as a percentage.

As a formula it looks like this:

For any dividend investor this is perhaps one of the most important metrics but probably the least used in practice.

The reason the Payout Ratio is important is because it give you the clearest indicator if the potential for a dividend cut is coming. If a company is paying out more in dividends then it earns the Payout Ratio will tell you all about it.

How does it work?

- DIVI-CENTS CORP has an earnings per share of $1 and dividends payout of $0.70 per share. This shows it has a Payout Ratio of 70%. Not Bad. Now lets look at the competition.

- DIVI-MART INC has an earnings per share of $2 and dividends of $2.55 per share. The Payout Ratio is 125%. Not too good!

Which company has the more sustainable dividend payout?

In some cases, a payout ratio can exceed 100 per cent.

Why should you care?

Depending on DIVI-MART INC balance sheet, it could possibly dip into it cash reserves or borrow depending on it’s credit, to keep the dividend going. The problem is a company can’t pay out more than 100% forever. Sooner or later it will be forced to do one of two things.

- Hope they can earn more money in the near future to cover dividend or

- Cut the dividend to a sustainable level

More often than not a company will cut it’s dividend.

As a dividend investor, this is the worst case scenario. When a company cuts it’s dividend, it’s usually a sign of distress and can cause a chain reaction.

Typically, when this happens, investors flee, causing the share price to drop so that the investor who stays ends up with a company worth less as well as a reduced dividend payment.

When you notice some holes in the ship, it’s better to flee and get your toes wet then to be stuck on board when it goes down and realize, there is no life vest.

A good read in this link. Oil investors see $7.4-billion vanish as dividends targeted