Last month was a new personal best with a dividend income of $716.88 in September. Let’s check out my dividend income for October to see where I end up.

But First

HALLOWEEN!

Halloween has come and gone and November is upon us. Everywhere I go, I hear complaints about this time of year. I live in Vancouver so it is wet, cold and cloudy almost all the time. But, perspective is everything!

I get to hang-out inside with the family and watch movies and play card games and get some real quality time together.

The rain gives me the perfect excuse to sloth around in my jogging pants. I love this time of year.

October Dividend Income

For the month of October I received dividends from 13 different companies (and 1 company twice):

| TICKER | COMPANY | Oct 2016 |

| TSE:CLF | Laddered Government Bond | $61.55 |

| WDC | Western Digital Corp | $60.00 |

| TSE:PLZ.UN | Plaza Retail REIT | $54.70 |

| TSE:DRG.UN | Dream Global Real Estate | $54.67 |

| TSE:AX.UN | Artis Real Estate | $47.97 |

| TSE:NVU:UN | Northview Apartment Real Estate | $45.36 |

| TSE:NVU.UN | Northview Apartment Real Estate | $29.33 |

| BEN | Franklin Resources Inc | $27.00 |

| TSE:REI.UN | Riocan Real Estate | $23.97 |

| TSE:D.UN | Dream Office Real Estate | $22.75 |

| TSE:BEI.UN | Boardwalk Real Estate | $19.13 |

| TSE:PZA | Pizza Pizza | $15.90 |

| TSE:XLB | Canadian Long Term Bond | $9.79 |

| TSE:ECA | Encana Corp | $7.26 |

| TOTAL | $479.38 |

I received $479.38 in dividends for the month of October. I’m very happy with this total as October is my lowest quarter of the three.

As you can see from the list above, over half of my dividend income is from REITs and I am very aware that I am overexposed to that sector at the moment.

There are 2 reasons for this.

The first reason is, I am finding it very hard to buy any company I consider overvalued. When reading through Warren Buffett’s letters, the one thing that he consistently states is that you look for reasons not to buy a stock. When you can’t find any reason not to buy it, then you pull the trigger.

I have been close to buying several different companies but there has been something that is just not right. The last company I bought was Western Digital and that was back in August.

I’m not going to buy a company just “because.” It has to make sense.

The second reason I’m overweight in REITs is because they pay huge yields that are safe and I buy new shares on the DRIP. When I buy new shares using a DRIP I usually get around a 3% discount on market price and the new shares compound. Even if the REIT doesn’t raise the payout, my payout grows every month. I like that.

Nuts and Bolts

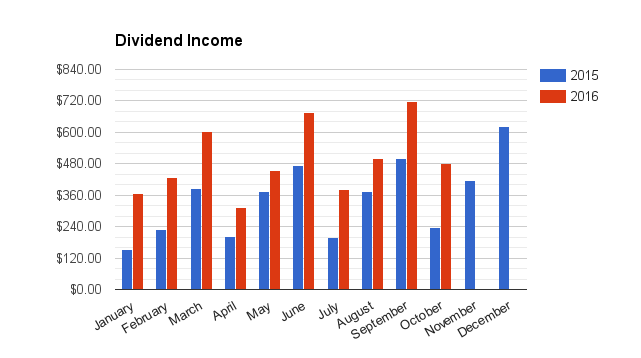

- My year over year increase was 103.13% or $243.38 more then 2015

- My quarter over quarter increase was 26.15%

Month |

2015 |

2016 |

$INC 2016 |

%INC 2016 |

Q OVER Q %INC |

| January | $152.00 | $367.00 | $215.00 | 141.45% | 55.51% |

| February | $229.00 | $427.00 | $198.00 | 86.46% | 2.15% |

| March | $385.00 | $602.00 | $217.00 | 56.36% | -3.53% |

| April | $201.00 | $313.00 | $112.00 | 55.72% | -14.71% |

| May | $375.00 | $456.00 | $81.00 | 21.60% | 6.79% |

| June | $475.00 | $676.00 | $201.00 | 42.32% | 12.29% |

| July | $200.00 | $380.00 | $180.00 | 90.00% | 21.41% |

| August | $375.00 | $501.00 | $126.00 | 33.60% | 9.87% |

| September | $499.00 | $716.88 | $217.88 | 43.66% | 6.05% |

| October | $236.00 | $479.38 | $243.38 | 103.13% | 26.15% |

Every quarter there are 3 months or dividend payouts, this is the smallest one.

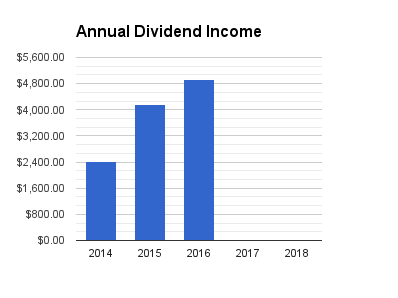

My total dividend haul this year is now $4918.26, already $749.26 more than my last years TOTAL!!

I have already crushed my last years total and I still have 2 full months left in the year!

I’m hoping to reach my goal of $6000, it will be close 🙂

I love October and Halloween. I live in California though, so my weather doesn’t change much in the winter. Great photos, it looks like everyone in your house got into the festivities. Kudos on another great month.

Investment Hunting recently posted…October Dividends And Options Income

Thanks IH.

You guys down there are praying for rain and up here it just never stops!

Great Job on your $2500 income for the month BTW. Great work on the options.

You beat me again Steve! 🙂 Argh! $9! Though it really isn’t a competition, I’m still impressed. Well done! I’m cutting it very close with my goal for the year as well. December may save me, but it’s hard to tell with mutual funds. We shall see!

PassiveIncomeDude recently posted…Passive Income Report: October 2016

$9 Woo!

I’m not too concerned if I meet my end of the year goals as long as I am moving in an upward direction!

I try to set lofty (maybe unrealistic) goals just to push myself, at the same time I know if i even come close to what I set out, I’m doing better than had I not set goals in the first place.

Thanks for stopping by Daniel

Nice perspective on the weather! Now that it’s dark when I get home from work I think my happiness would benefit from a similar pivot of thought.

Congratulations as well on the awesome dividend income. The best part is, it’s only going to keep growing! 🙂

Jay recently posted…Trend Following Stock Picks November 2016 – Election Edition

Like they say “perspective is everything” 🙂

I have saved up enough of a safety net, now I plan to buy a little bit more aggressively.

I still think the market (US) is due for a correction but you can’t time the market.

Sloth away!!! The beauty of dividend payments too. When it’s cold and wet outside and you can spend indoor time with your family while also getting paid. Solid income for October too. While you may be heavy in real estate there are some names selling at better values and yields these days like KMB, TROW, TRV, UL and VFC too. Just a few to consider. Thanks for sharing.

DivHut recently posted…Dividend Income Update October 2016

Thanks for those names Keith.

I do like many of the US companies and have been looking at TROW and ABT recently.

I have to wait until Jan to open up room in my RRSP before I can make a US purchase do to withholding taxes.

I’m also looking at Fortis and Shaw on the TSX.

You are smashing last years total dividends! Congratulations are already in order and it’s only November! a lot of REITs are great investments, I can’t blame you for being overweight there.

Love the photos of your Halloween

Jasmin

Dividends Down Under recently posted…Saving for the future: October 2016

Thanks Jasmin

I worry about my REITs but I also love them. Monthly payments, low P/E and a sustainable dividend, almost too good to be true 🙂

What do you think of WDC moving forward? I owned them back in the day but am worried about their future growth prospects.

I liked WDC when I bought it for $47.50 because it was the only stock in the S&P 500 that came up on my screener as very undervalued.

It’s gone up $10 since I bought it and it no longer meets the criteria to buy.

That being said, I really liked the SanDisk acquisition. According to Morningstar, their current ratio is 3.14 and QR is 2.62 respectively. Add on a sustainable 3.5% yield and it doesn’t look too shabby. Disclosure I’m long WDC and would probably not add more at the current price.

Hey Steve,

Congrats on already surpassing your dividend income of last year. I did too! But I don’t make nearly as much in dividends as you do. Amazing job man! Keep it up 🙂

Graham @ Reverse The Crush recently posted…9 Ways To Maintain Originality No Matter The Environment

Thanks Graham,

Onwards and upwards from here!

Great month ! I am about right there with you for Sept and Oct. Feeling good about the increase every month as I am sure you do as well. I think you are smart to be concerned about being overweight in REITs. They are great investments, but everything in moderation. I have O, OHI, and WPC . I own 27 stocks so this is acceptable for my level of tolerance. I think it is such a personal preference and what you feel comfortable with. Nice job on the income and keep it rolling. I look forward to reading more of your posts. Good Luck !

-Brian

Hi Brian,

I was actually thinking about writing a post about the acceptable number of companies a person should own in their person financial portfolio.

It really does depend on the person.

If Canadian interest rates rise I can see some REIT’s getting hammered. It’s a tough market out there and with the DOW cruising past 19,000.