Last month I received a dividend income of $639.32 for January. It was a great start to the year and I hope to keep the momentum going. Let’s check out February.

This year, my goal is to pass $8,000 in total dividends received. All I need now is a measly $7,360 🙂

February Dividend Income

For the month of February I received dividends from 12 different companies.

| Ticker | Company Name | Amount |

| TSE:AX.UN | Artis REIT | $100.44 |

| TSE:NVU.UN | Northview Apartment REIT | $87.72 |

| TSE:RY | Royal Bank | $87.15 |

| TSE:PLZ.UN | Plaza REIT | $72.52 |

| TSE:CLF | Bonds | $55.31 |

| TSE:D.UN | Dream Office REIT | $37.88 |

| TSE:SJR.B | Shaw | $30.62 |

| TSE:ALA | AtlaGas | $26.51 |

| TSE:BEI.UN | Boardwalk REIT | $19.13 |

| TSE:PZA | Pizza Pizza | $16.04 |

| TSE:PWF | Power Financial | $14.92 |

| TSE:CPG | Cresent | $9.00 |

| TOTAL | $557.24 |

I received $557.24 in dividends for the month of February.

What should I do with all this free cash? I could buy a new…

Playstation 4 Pro (with one extra game)

Nope!

As any reader knows, I prefer to spend my dividends on things that go up in value. I chose to DRIP my dividends.

I know many people don’t like to DRIP and prefer to take cash instead. The reason I like to invest my money through dividend reinvesting is 2 parts.

- I don’t pay a transaction fee, which doesn’t seem like much, but they do add up fast.

- I get a DRIP discount on new shares below market price, usually by around 5%

Nuts and Bolts

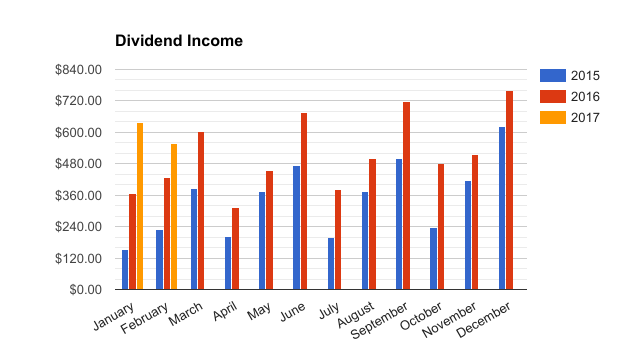

- My year over year increase was 30.50% or $130.24 more than February 2016

- My quarter over quarter increase was 33.32%

- Another solid quarter

| Month | 2015 | 2016 | 2017 | 2017 $ INC | 2017 % INC |

| January | $152.00 | $367.00 | $639.12 | $272.12 | 74.15% |

| February | $229.00 | $427.00 | $557.24 | $130.24 | 30.50% |

| March | $385.00 | $602.00 | $0.00 | 0 | 0.00% |

| April | $201.00 | $313.00 | $0.00 | 0 | 0.00% |

| May | $375.00 | $456.00 | $0.00 | 0 | 0.00% |

| June | $475.00 | $676.00 | $0.00 | 0 | 0.00% |

| July | $200.00 | $380.00 | $0.00 | 0 | 0.00% |

| August | $375.00 | $501.00 | $0.00 | 0 | 0.00% |

| September | $499.00 | $716.88 | $0.00 | 0 | 0.00% |

| October | $236.00 | $479.38 | $0.00 | 0 | 0.00% |

| November | $418.00 | $514.57 | $0.00 | 0 | 0.00% |

| December | $624.00 | $760.03 | $0.00 | 0 | 0.00% |

| YTD Total | $4,169.00 | $6,192.86 | $1,196.36 | $402.36 | 0.00% |

One of my goals for 2017 is to increase my dividend payout an average of $170 per month. I’m slightly ahead of schedule with an average increase of $201 per month. ($402/2)

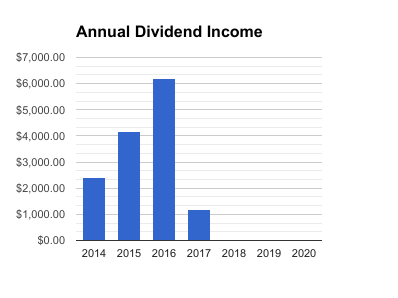

My total dividend haul this year is already over the thousand dollar mark sitting at $1,196. It’s crazy to think that I have already accumulated 50% of my 2014 total in just 2 months! How cool is that.

How Much Free Money?

| Year | Total Dividends Received |

| 2014 | $2,421.00 |

| 2015 | $4,169.00 |

| 2016 | $6,193.00 |

| 2017 | $1,196.00 |

| 2018 | $0.00 |

| 2019 | $0.00 |

| 2020 | $0.00 |

| Total | $13,979 |

Since 2014 I have received $13,979 of free money just to own some companies.

That’s enough free money to buy my a brand new…

2016 Bayliner 160 OB

Stay classy Fire bros

Keep DRIPing, next year, you will be able to pick up two PS4 Pros, maybe three 🙂

Dividends 4 Future recently posted…February 2017 Income Update

True!

The power of compound interest.

I love your picture-cost references, lol. Glad you decided against the PS4.

Way to go Steve! You are crushing 2017 while I am limping into March of 2017 begging for mercy. 😀

Passive Income Dude recently posted…Passive Income Report: February 2017 (TERRIBLE!)

Thanks Dan,

I’m sure your 2017 will work out for the best. I’ve been through lots of financial ups and downs but the those who are patient always win in the market.

I always like to think about what the investing income could have bought me, it’s like a mental Christmas present every month. I’d like to look back here in 30 years and think about all these toys I could have bought, and how they would have all ended up in the trash bin. Then look at my new dividends and see 10 grand rolling in every month 🙂

Keep pushing Brother.

Congrats on a fine month. Go ahead and buy the gaming system 😉

Investment Hunting recently posted…Stock Sell – Principal Financial Group

Thanks IH.

Instead of the PS4, I bought some O- Realty Income Corp 🙂

Awesome February! Those REITs really add up.

Scott

Scott recently posted…February 2017 Income

They sure do,

I’m interested to see where REIT’s will end up with the upcoming interest rate hikes. Most of the talking heads think they are going to head south but I feel the market has priced the upcoming rates into the current levels.

In any case, the speed of the rate increases should be slow enough that any properly managed REIT should be just fine.

That’s a very solid amount to bring in for a “slow” month like February. Looks like a lot of REITs are doing the lifting for the month of passive income. Also, I love seeing a Canadian banks in the mix too. Like you, all my divvys automatically get reinvested. Compounding at work! Thanks for sharing.

DivHut recently posted…Recent Stock Purchase II March 2017

Hey Keith,

I’m heave in REIT’s but I think they are unloved due to interest rates. I actually think they are a better value than most stocks at this point. Saying that, my last 5 purchases have all been stocks, all of which are in the Dividend Aristocrats list or Canadian equivalent.

Looking good. Maybe if you’re looking in 20 years you can buy a 100 foot yacht! (lol jokes, those things are ridiculously expensive to maintain.)

The secret about boats is don’t own! Use your buddies 🙂

Thanks for sharing your dividend income and put together all your charts, Steve! You’re doing amazing! I definitely DRIP all my shares too. Now that I’m working at a Canadian FI, and am investing through their profit sharing program, I am wondering how to blog about my dividend holdings without it being a conflict of interest. Also, I noticed you hold a lot of reits. Any opinion of Riocan? Looking forward to your March report.

Graham @ Reverse The Crush recently posted…Blog Numbers and Income report for February 2017

Hey Graham,

I have owned Riocan off and on for about 10 years. It’s a staple of Canadian REITs. The only problem I really have with Riocan is the size. It’s hard to grow when you own most of the space.

My favorite REITs right now are NVU and PLZ, both of which grow their dividends yearly.

Cheers