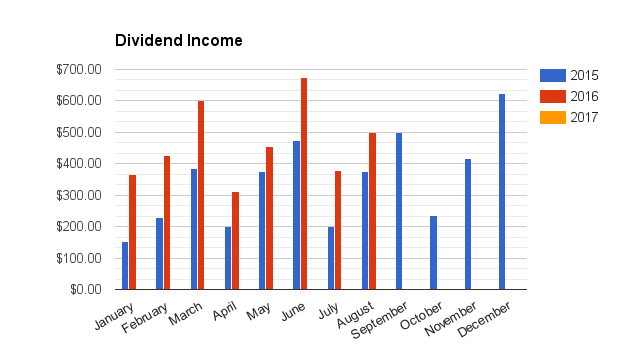

Good Bye $400’s

Hello $500’s!!

I received $501

in dividends in AUGUST.

My year over year increase was 33.60%

My quarter over quarter increase was 9.87%

Every quarter there are 3 months or dividend payouts, this is the middle one.

My total dividend haul this year is now $3616

I’m on pace to pass my last year total next month!

With 4 more months of dividend growth, this is going to end up being a most excellent year.

I love them dividends!

Market Musings

The Dow kept on pushing record highs in August off weak earnings.

I like to use the Schiller P/E ratio to gauge the value of the overall market.

August – S&P 500 had a Shiller P/E: 27. Up (being bad) 0.1

from July

That is 61.7% higher than the historical mean of 16.7

Prof. Robert Shiller of Yale University, who won the Nobel Prize in Economic Sciences in 2013 – invented the Schiller P/E to measure the market’s valuation. He also predicted the crazy P/E ratios of the late 90’s would turn out to be a bubble.

I continue to move to safety.

Moves in August

Total Purchases $7393

Total Sales $4719

I sold 120 shares of AP.UN this month at $39.33 per share for a total of $4719. That equals a 25% capital gain since Feb 24, not including dividends.

AP.UN has heavy exposure to Toronto and has shot up above what I consider a reasonable level. It’s P/E, payout ratio and distribution started to look suspect.

I bought 332 shares of TSE:NVU.UN at a price of $22.27 per share for a total of $7393. This brings my total shares to 547. Hahaha, I bought this the day before the earnings report was released which I try to always avoid. I’m not sure why I never looked when the next report was due but live and learn. The new earning report was not great but is no reason for me to panic. The shares dropped the day after I bought them down to $20. Lesson! Don’t buy off old news.

Following Step #2 in 3 simple steps to becoming rich, I’ve added another $3000 into savings cash.

I’m just about $50,000 with cash and bonds now. This will supply me with what I need if the market decides to start making sense again.

Going forward

“Only when the tide goes out do you discover who’s been swimming naked.” -Warren Buffett

I will be allocating 25% to bonds and 75% to stocks until the end of the year when I will rebalance and change directions if need be.

My plan is to buy one or two companies on my U.S. watch .

I will look to buy heavy if the DOW gets as low as 17000.

Awesome month. You have those dividends rolling in now

Doug recently posted…Altria dividend increase

Thanks Doug,

I’m starting to see the benefits of the compounding interest. I’ve been using drips for most of the companies I own to save on commission cost but will switch to pure cash fairly soon.

Nice month! I’m agreeing with your holding of a solid chunk of cash right now. Things are just too crazy. Hopefully opportunity shows itself soon!

Hi DividendStacker,

Things are crazy. I can’t make any sense of the market.

One talking head says oil is going to $20 (GS) and another says it’s going up to $90 next summer(cnbc).

I’m pretty sure that every smart person out there is just flipping a coin at this point. Heads it goes up, tails it goes down.

The nice thing about holding some cash is i’m happy if the market goes up, i’m happy if it goes down 🙂 win/win imo

Congrats on the $500 mark. This is a serious haul. You’ve got me beat for this month. I’ll end up somewhere around $350.

Investment Hunting recently posted…Selling Options And Earning Income – August 2016 Update

I might have beaten you in the dividend department but you killed it on the options.

I’ve often thought of using covered calls with companies I want to sell but have never really tried it out.

If you’re ever interested reach out and I’ll send you the list of books and resources I used to learn about options. I’m hooked. It’s fun and it keeps me really close to market trends. But it does come with risk. Options are not for everyone.

Investment Hunting recently posted…Cash Secured Put – Valero Energy

I’m very interested. I love learning about new financial tools.

I’ve looked at laying down some covered calls on different stocks that I would not mind selling but have never pulled the trigger.

Thanks IH!

$500 is an extremely impressive milestone! Congratulations! Maybe sometime next year I will reach this number. Keep up the good work!

$500 is great because it will almost get me a whole new position. I drip everything I can right now but I like picking new companies.

Hope you hit the $500 milestone soon John

Rock on DiviCents! I love the simple method you use to report this information. Very clear and straightforward.

And $500 is great! Definitely not too shabby when you essentially get $16 per day for doing nothing. 🙂

Impressive YoY growth too! But I’m most excited for you to get a rental property and “slum it up” as you say. 🙂 Keep it up,

Thanks PID

It looks like the Vancouver real estate market is slowing down and I’m hoping there is a big correction to come. I plan on never selling my place so the high prices don’t do much for me except deter me from picking up a second house.

I’m going to patient here and weight before I pull the trigger on the house. I’m already pre-approved so I don’t see a reason to rush.

Great month. Congrats on $500 mark.

It is a crazy market right now. I also have some cash waiting to get invested

Cheers,

Pollie

Thanks Pollie

Very crazy market.

It never hurts to have some money on the sideline for the unexpected.

BTW, I like your analysis on BEN, I use I very similar method.

Awesome stuff. And thanks for stopping by so I could find your blog.

Hey Greg,

Us dividend investors need to stick together!

Great month and excellent quarter-over-quarter and year-over-year percent gains! Let’s hope for a few down months to finally find some value stocks again!

BTW, just added you to my blogroll.

Scott

Scott recently posted…August 2016 Income

Thanks for adding me to your Blog Roll Scott 🙂

Reading other DGI websites like yours helps me stay motivated.

I recently sold my shares of KMI. That was a massive, unexpected Div Cut. I’m glad to see you keep pushing forward.

Hey Steve. Thanks for sharing.

I’m glad I’ve found you and will be travelling with you on your journey.

Keep up the great work and make your family proud.

Cheers bro and take care.

Thanks Hustler.

It’s great to have a family that is fully supportive of my adventures!

Hello fellow Vancouverite! $500 in dividend income for August is pretty awesome. What’s even more awesome is your impressive 33.60% YOY increase. Haven’t tallied our August dividend income yet but probably will come in between $1,000 and $1,100. Got to love doing absolutely nothing and getting paid.

Man, I can’t wait to hit that $1000 mark.

That is a huge milestone but probably a couple years away for me.

“Got to love doing absolutely nothing and getting paid.”

I love going away on a trip or a holiday and thinking to myself “I’m getting paid right now!”

Thanks for swinging by Tawcan.

Awesome, freaking, stuff. Over $500….are you kidding me. Your growth rate is extremely impressive and you are really seeing the benefits of all this capital being poured into your portfolio. Love the pictures and it was a very entertaining article to read haha Looking forward to what September has in store for you!

Bert

Thanks for the positive feedback Bert 🙂

$500 is a big milestone but like you mention, it’s the growth that really matters. It seems slow at first but now it’s starting to add up 🙂

I also look forward to seeing yours and Lanny’s growth. Thanks for stopping by.

Congrats on a very solid number for August. It’s always a great feeling seeing that passive income roll in. Looks like you have been pretty busy with buys as well. My buying has really slowed down the last three months or so but I still manage to add to my portfolio at least once a month as I have been doing for many years. Consistency is one of the keys to successful dividend investing. Thanks for sharing.

DivHut recently posted…Recent Stock Purchase August 2016

Hi DivHut,

I’m kind of on the same page as you. I’ve slowed down on stock purchases and am hoarding a bit more cash or equivalents.

I will still buy some companies here and there but they need to make sense. I’m still trying to find value but when I run my screeners, they usually come up blank.

WDC just popped up and I recently added small position but I still need to do more research if the EPS miss will continue. It could be a trap. It’s down over 40% in it’s last 12 months and there is some uncertainty with the SD acquisition although I see the purchase as a very smart move to shift from HDD to SSD which is the future. Time will tell.

Until then…

Congrats on the big August – it’s looking like you’re on the right track. I do agree with you the the market seems a bit overvalued right now so I’m keeping more cash on the side as well ready to buy whenever(if ever) the market drops again. However, with the low interest rates that are likely to hang around for quite some time – I’m not sure if that’ll happen anytime soon.

That is the problem, there is no other place to put your money with these low interest rates.

I do think that is causing the market to move up as well as QE and easy money. The Bull market could still move up for some time but nothing last forever.

The higher the market goes the more cash as a percentage I will hold in bonds or cash until I reach perhaps 50%

Thanks for the comment Timeinthemarket.

Great month Steve!

$500 from dividends is amazing! That could cover quite a bit of expenses in a month if you wanted to use it. I also think you are wise to be staying cautious with the Schiller P/E ratio that high. But you’re proving that dividend investing works regardless of the market conditions. Congrats on reaching over $3600. Thanks for sharing the report! Keep it up 🙂

Graham @ Reverse The Crush recently posted…Blog Traffic, Social Media & Income Report for August 2016

That Schiller ratio is chilling to me! I believe it has only been higher on 2 occasions. 1929 and 1999…

It still seems surreal to me that I have received $3600 for essentially pressing a button on my computer. As the saying goes “money makes money”

I still have a long ways to go before I can reverse the crush but i’m making headway.

$500 is definitely nothing to sneeze at. I’m finding that the numbers start out small and then compounding makes each dollar easier to “earn”. I use the quotes because I’m not really earning the income; I’m getting a return on my investment from money I earned last year. Dividends are great, and the growth is even better.

I actually was bored and figured out what my compound interest was per month. It’s sitting around $3!

That doesn’t seem like much but a $3 increase every month equals $36 in the year! That is enough to pay a cell bill for life!

After 2 years that would be $72 extra dollars per month just off the money that money makes!

Sorry, I get excited off this 🙂

Thanks for the encouragement Chris

Awesome job Steve, you’re having a really good year so far. It does seem to be difficult to choose good stocks at good value at the moment – for any buyers buying at the moment, they’re having to sacrifice a bit on one of those 2 things.

Tristan

Dividends Down Under recently posted…Saving for the future: August 2016

You’re right Tristan, it’s a tough market to really understand. You either buy an expensive stock with a real possibility of a market correction that is LONG overdue or you hold cash and lose to inflation. I’m thinking about a 60-40 split of 50-50.

$500 is awesome. That is a big milestone. You are killing it and I look forward to seeing how quickly you are able to make it to the $1,000 milestone!

The $1000 is the goal More Dividends!

Short term goal that is.

If all goes well it should be under 2 years but life always has a way of squashing the best laid out plans 🙂

To be honest, i’m not really paying too much attention to the total amount but rather trying to continually grow quarter over quarter and year over year.

That is a smart plan. As long as your achieving the small increases quarter over quarter, you will cross the $1,000 in no time. I acknowledge my quarterly amount but probably focus too much on the total amount.

Pingback: August Dividend Income From YOU the Bloggers! - Dividend Diplomats

Great information.

Thanks David.

Pingback: Dividend Income Roundup - August 2016 - $9001.57 - Dividend Ten

Nice gain on Allied Properties. I also like Franklin Resources on your U.S. watch list…good, solid name to hold for the long-term. Thanks for sharing.

Thanks S.W.

I think I was a bit lucky on Allied but I’ll gladly take some money off the table 🙂